Note to readers: Our posting pace in recent months hasn’t exaclty been torrid, you might say. We won’t bore you with why. But we did want to mention an administrative point. If you’re signed up to get an email whenever we post new items, you may want to check the SPAM folder in your email system.

We use the service ourselves as a sort of error check. We inadvertently discovered that the email notices were ending up in our SPAM folder. It’s hard to know how SPAM filters work, but one way is if the “from” address is one you haven’t received mail from before and read, so it’s not saved in your address book. When that happens in my system, the trick is to move the subject message to your inbox and open it up to read. Hopefully that should correct the problem for you if you have it.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Now to the subject of this post. We think every one who pays property taxes in Brunswick, the richest little town in America, should be ashamed. We expect you to show it when you go about your daily business, with body language appropriate to your behavior.

Why? Because as your Brunswick School Department points out in this year’s Budget Presentation, there are other towns in Maine that spend more per student than we do! How can you not be embarrassed?

You wouldn’t let a friend or neighbor outspend you to feed your family, would you? If they were paying more for their car insurance, or more on their electric bill, you wouldn’t stand for that, right? You’d call your insurance agent and ask him to raise your premium, and start leaving all sorts of lights on 24 hours a day to make up for your shortcomings, wouldn’t you?

That’s exacty the mentality embedded in our School Department. Take a look at this Budget Proposal Book for FY 2019:

http://www.brunswick.k12.me.us/school-board/files/2018/04/FY19-BSD-Board-Proposed-Budget-Booklet-2018.pdf

While we could not get confirmation of this, our take is this document contains all the earmarks of a hired consultant used to put the package together, and in the process, combine virtue signaling with budget shaming. Our guess is that “Good Group Decisions,” a Brunswick firm, has become good friends with the School Department, and may be tutoring them in the finer points of persuasion.

We note that the Booklet opens with three full pages of “Points of Pride,” loaded with lovely photos, to soften up the room. In our view, “Points of Achievement" might have more meaning, but we’re just old fashioned fuddy-duddys.

This is followed by a page on “Strategic Framework,” loaded with all the language of pop-psycho babble you get when using a firm like this, which the BSD did for developing this plan a few years back. Rather than lay out tangible, measurable objectives, it overflows with touchy-feely emotion-laden rhetoric like embrace, positive, proactive, and community.

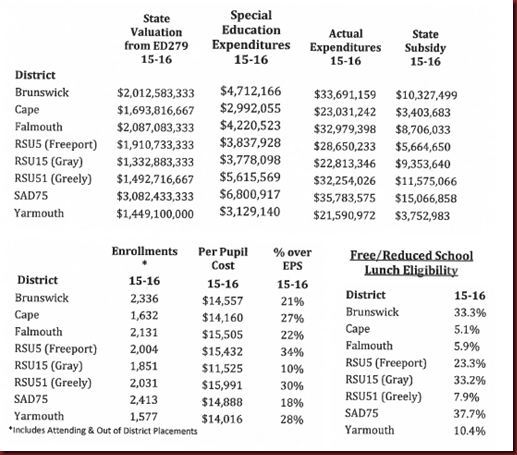

Then comes “Benchmarkiing Against a Peer Cohort.” In other words, demonstrating how the BSD has greater burdens and spends less that others. How they selected the peers is not explained.

Frankly, if you can stand looking at it, you’ll find the first 13 pages are designed to soften up the reader to a sympathetic position of saying “please, please, spend more; we’ll pay whatever we have to in order to contribute our fair share and treat our children well.” And to make sure we’re first among out peers, right? Whether it be the Jones or something else.

Note that when they show the enrollment changes, they don’t show the pre-base closure numbers when they enrolled 1,000 more students, and when they left town, how much budgets declined accordingly. Along with employment. Because they didn’t. Showing that data would be embarrasing.

Ten years ago, when we had 1,000 more students, and more schools operating, we were spending in the $10 thousand range per student. Now, with fewer school plants and 1,000 fewer students, we’re spending $16 thousand plus per student. Presumably you’re spending 60% more on all your household budget items, including property taxes. And your income has increased by 60% to pay for it.

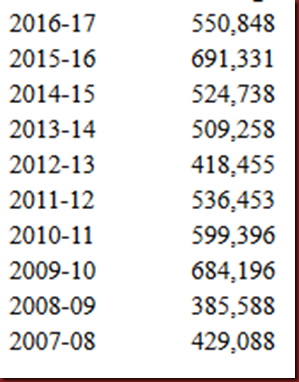

Enough whining. Instead, we’d like to give you another spending yardstick here in Brunswick. The figures below are for street resurfacing in the recent 10 years:

These are figures in the Public Works budget, and do not include amounts for street reconstruction, which we’re following up on. These work out to an average of something like $533,000 per year to maintain our town thoroughfares. Not that the condition of our streets matters in the larger sense.

But in an era when town budgets exceed $60 million, and school budgets are approaching $40 million, we think it lends a sense of perspective. And how poorly we’ve all done at seeing that some sense of proportion exists in town priorities.

$533,000 is not much more than a rounding error in the school budget, but it’s the total we spend to keep our streets in decent condition….or not.

Clearly there’s enough shame to weigh everyone down.

Oh, and one more thing. When you study the School Budget Booklet in detail, which we know you will, please take note of the pages on which our public servants go into detail on student achievement and how it compares to the other school systems in our peer group. And how they compare the performance metrics for the teachers in the same vein, other than comparing average salaries, which does little more than tell you about the average age of the cohort. Why? Because if the peers compensate their teachers the same way we do, pay is determined almost exclusively by how many years of service you have, not by how good a job you do compared to your peers.

Performance does not enter into the equation at all. And why would it, if student performance isn’t a primary indicator of Department metrics?

This is just the idea of participation trophies taken to the next level. Teachers and students are evaluated solely on the basis of participation, not excellence and achievement.

Think about that the next time you need a brain surgeon.